Working Capital Optimisation

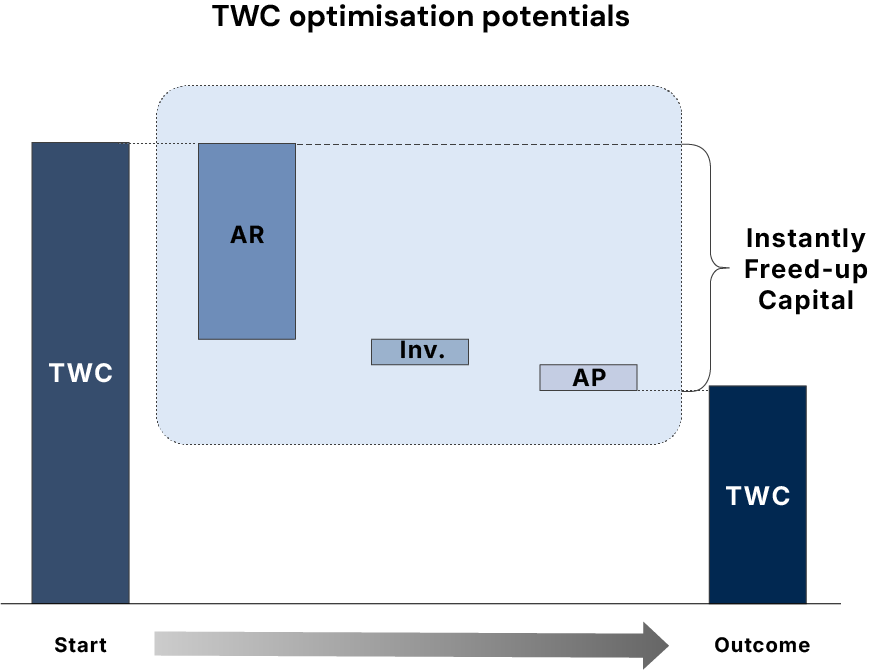

Our experience in Working Capital engagements shows that typically 80% of savings result from accounts receivable optimisation while about 10% is delivered by inventory reduction and accounts payable optimisation respectively. Consequently, accounts receivable reduction is the most effective way to start a Working Capital improvement project.

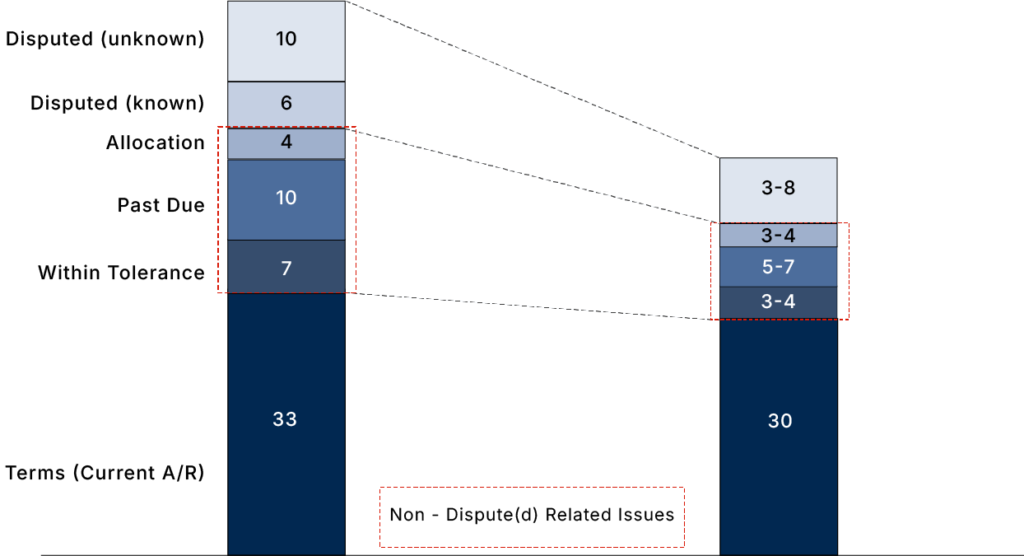

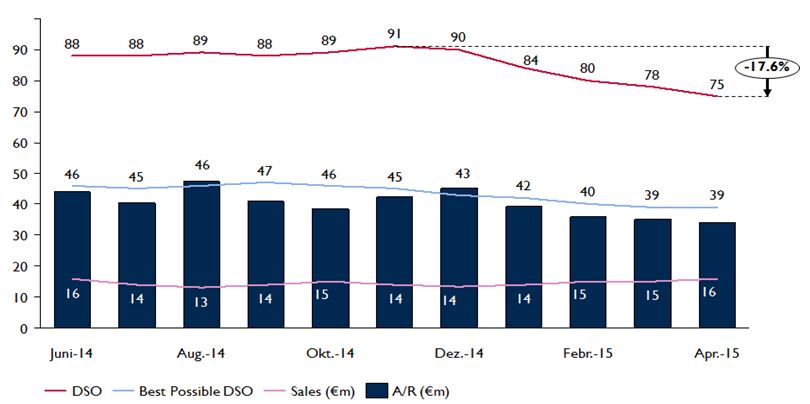

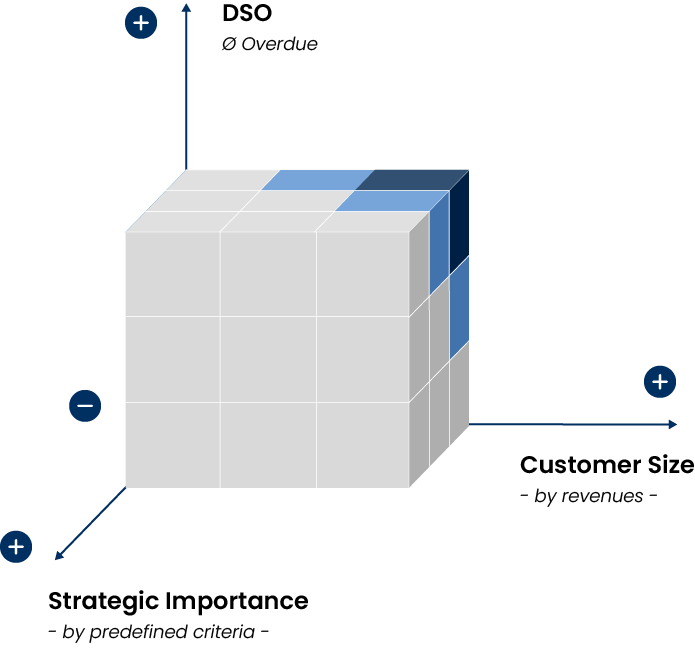

Accounts receivable improvement requires cross-functional commitment and continuous communication to achieve sustainable change in the key Working Capital improvement processes: new customer set up, sales and contract management, risk management, order processing & billing, cash targeting & collection management, cash allocation, dispute & deduction management. Accordingly, DSO can often be significantly reduced, overdue receivables even cut in half in the short to medium term to deliver substantial benefits.